Recapture: Inside the controversial school funding laws

May 6, 2019

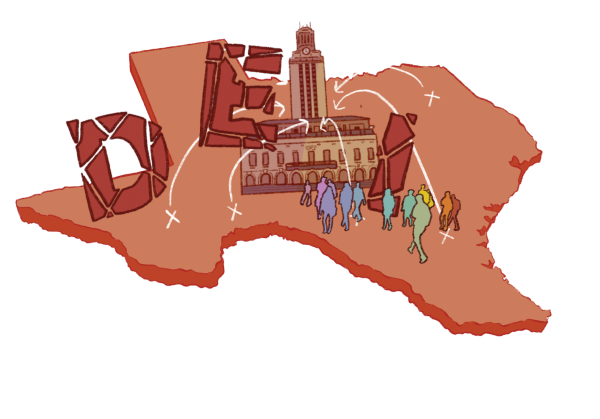

As Austin taxes climb, nearly half of the school district’s income is sent out of the city. $670 million in recapture payments will be sent to the state in 2019, who distributes the money largely to school districts with much lower incomes from local taxes. The exchange sustains property-poor districts like Brownsville, where almost all students are economically disadvantaged and which receives over 70 percent of its funding from the state. However, it has left many in Austin Independent School District (AISD), which pays the most of any district despite large populations of at-risk students, feeling cheated, and led to a push for education finance reform.

Recapture was created with the goal of equalizing per-student funding between property-poor districts and property-wealthy districts by re-allocating money from the property-wealthy districts to the property-poor. Payments are calculated based on taxable property values within a school district, divided by the number of students attending school. Districts considered property wealthy (often highly populated cities) give a portion of their local tax revenue to the state. This money then goes into state funds, which are distributed to qualifying property-poor districts.

Hector Zamarripa teaches high school students in the Brownsville Independent School District (BISD), a property-poor district that received funds from the recapture program during the early years of the program. Zamarripa disagrees with the way recapture is set up at the moment.

“The way I feel like it’s structured is it hits ‘rich districts,’ and I use that in quotations, versus, again, ‘poor districts’ in quotations,” Zamarripa said. “And it doesn’t have to be that way. You know, we’re they pitted against each other in the sense of, well, you know, you got to pay for them. But perhaps if all of us just looked at the state and said, wait a minute, why aren’t you guys stepping up?”

According to Edna Butts, AISD director of intergovernmental relations and policy oversight, now is a crucial time for education finance reform. School funding is a hot topic this legislative session as multiple bills have been proposed in the House and Senate to increase education funding. However, time is running out as the legislative session is scheduled to end May 27, 2019.

“I hope that taxpayers will be more active in letting their legislators know how they feel about public education, and they go vote,” Butts said. “A lot of taxpayers are. We have a lot of really wonderful parents who are very involved, and are more and more involved because they don’t want to see their tax dollars go to the state and the state not paying their share.”

Sylvia Atkinson, vice president on the board of trustees at BISD, said Brownsville does not receive recapture payments directly. BISD receives over $325 million dollars from the state for their 48,000 students, and pays under a million dollars in intergovernmental transactions. In comparison, AISD receives $78 million for 80,000 students, and pays over eight times as much as that to the state.

Atkinson said she supports recapture reform, there are many property relief bills which concern her, as many lawmakers are wanting to give property owners tax breaks.

“I can tell you, as a property owner, it’s appreciated,” Atkinson said. “However, if it’s going to limit the amount of money that goes to public education, I’d rather keep paying my taxes. So I think there’s a healthy balance that could be struck, that it’s going to take a lot of compromise and a lot of a lot of focus on what’s important, which is for, you know, the wellbeing of our students.”

Atkinson supports a reform that would allow property-wealthy districts to pay less if over half their students are at risk of not graduating. At-risk students are often English language learners, students who receive special education or students belonging to lower socioeconomic statuses.

“It would show that the state recognizes that yes, you might be a little bit more property rich than others, but you’re also dealing with a very serious population that the state wants to address,” Atkinson said. “I don’t think the state wants us to not have money and additional money to help our at-risk populations.”

According to Butts, one impact of recapture is the rising number of families who move to surrounding school districts because, as taxes rise, they can no longer afford to live in Austin. This lowers the student population, a key issue in the under-enrolled AISD, and ironically raises the district’s recapture payment.

“When we’re having to pay so much money to the state, it’s money that we don’t have to spend on programs for students,” Butts said. “We have real challenges in our school districts. Over 50 percent of our students are low-income, 27 percent speak little-to-no English. We have over 90 languages spoken in our district. So it takes resources to educate children who have these needs, and we’re not necessarily able to put in all those resources to help kids.”

According to Butts, Texas has been supplanting state-funded education support with local recapture payments. She said the best solution would be for the state to continue paying what they had been and keep collecting money until they can reach a 50-50 split with local districts, reducing property taxes.

“If the state puts more money into education, our recapture payment would actually go down,” Butts said. “There are other bills that have been filed that would put a cap on how much was collected by recapture, just to try to reign it in a little bit. It’s not that [AISD is] against recapture, it’s that at this point it’s getting out of hand.”

Austin’s recapture payments are increasing, Butts said, because Austin neighborhoods are getting more expensive to live in, while the overall population living within AISD decreases. Butts believes “taxparency”, an effort for property tax bills to disclose money districts are keeping and sending to the state, would help taxpayers understand the flow of money going on.

“I think it’s that taxpayers would realize how much their property taxes would fund education when it’s actually the states’ obligation,” Butts said. “I think they would realize that they need to be more involved in urging the state to do its part to fund education.”

According to Zamarripa, teaching at a school in a property-poor district means he has to get creative with what he has available.

“I mean, it’s, it’s not ideal, it’s imperfect, and it’s frustrating at times, but the job has to get done somehow, you know, and I can sit back and complain and whine and say, ‘Oh, you know, I can’t do my job,’” Zamarripa said. “But at the end of the day, it’s the student that suffers. So, you know, I do what I can we do what we can here, you know, that involves having to work a little harder, you know, we do it, because that’s the job we signed up for. But it doesn’t mean it’s right.”

Recapture is not the only program that aims to help poorer schools and school districts. Title 1 is a federally funded program for schools with a large population of at-risk students, and available even in areas where property taxes are high. While AISD has some Title 1 schools, every Brownsville school qualifies for the program. Zamarripa said his district relies largely on federal programs.

“Title 1 is a massive deal in our school district, and it perhaps shouldn’t be that way, you know, an argument can be made that we shouldn’t have to be relying on the federal government to fund our programs,” Zamarripa said. “I mean, it’s great, and we’re going to take the money and, and, you know, I think we do what we can to utilize it. But something is not right about that…we as individuals cannot live beyond our means. If I have to rely on credit cards and loans to operate or to function, and that’s not a good thing.”

Many of Zamarripa’s students come from low-income, economically disadvantaged, or single-parent households. He said the economic poverty in the Brownsville community is the real issue, and at the very least school faculty can make sure students have the basic needs and supplies.

“I think studies have shown that education is the key to leaving poverty,” Zamarripa said. “I think education is the key to growth and success. But I still do believe in some checks for that, you know, if that waterpark thing, you know, that breaks my heart to hear that. So yeah, I just wish our lawmakers would, you know, make sure that we’re adequately met with funding just make sure that we can get the basic and equitable chance I’m not saying that they need to pay for everything… just give us a chance is what we’re saying you know, we can get it done right.”

Adding to the controversy of recapture are allegations of misuse. La Joya Independent School District, a property-poor district near BISD which receives recapture funds, built a publicly funded waterpark in 2018, quickly drawing ire from state media.

“That does sound like an abuse of taxpayer money, and I’m surprised that it was allowed to even get built,” Zamarripa said. “You know, I’d be very interested to see what the justification for that was. That kind of breaks my heart too, because, as I said, we’re fighting for paper over here.”

According to Butts, many legislators have brought up the La Joya waterpark as an example of poor decision-making by a school district using taxpayer money, and an inspiration for reform. Although AISD would never build a waterpark, she said, she does not know the reasoning behind this decision.

“What it’s doing is, there are a lot of bills that have been filed this session about what has to be in a district like we passed the billion-dollar bond in 2017 to update our buildings, modernize them, fix things,” Butts said. “There are a lot of bills that would make it more onerous for districts to pass bonds, and I think they’re using the La Joya waterpark incident as the reason why.”

Atkinson thinks that while AISD does well with what they have, the district could use more funding.

“I think the state hurts their efforts to really provide the best opportunities for their students by taking their money and allocating it elsewhere,” Atkinson said. “I think the school district, this whole district suffers in that sense.”